Customer Lifetime Value: What is it, How to Increase it

Customer lifetime value indicators are used in marketing to plan business development, optimize customer relationships, develop loyalty programs, and more. They can be ambiguous and difficult to calculate, but they can help you improve the accuracy and efficiency of analytics.

We will explain in detail what these metrics are, why they are so important, and how you can improve them.

What is Customer Lifetime Value (CLV)

Customer lifetime value is an expected profit that a business can get from a customer throughout the entire cooperation period. It includes all transactions that generate profit for the company. These can be:

- sales;

- subscription fees;

- commissions and service fees;

- paid consultations;

- trade-in operations, etc.

When asked, “What is lifetime customer value?” marketers often disagree. Most of them calculate it based on total revenue. However, this is not always correct. If a company offers a wide range of products with different margin levels, profit will always come first, which requires taking costs into account.

To demonstrate CLV’s meaning in practice, let's look at a few examples:

- An average subscriber of a mobile operator pays $120 per month and maintains a relationship with the company for 5 years. Accordingly, its value will be equal to 120×12×5=$7200.

- Customer A buys an average of $300 worth of fresh flowers from the store every 3 months, and Customer B buys $50 worth of cleaning products every month. The margin of the first category is 33%, and the margin of the second category is 10%. Over 3 years, the value of customer A will be 300×(3×12)/3×0.33=$1188, and the value of customer B will be 50×12×3×0.1=$180.

- A loyal customer of an automobile company buys a new car every 5 years for 25 years. The average cost of the product is $30,000. However, the manufacturer also receives $2500 annually by providing parts for routine maintenance. The customer's value would be 30,000×(25/5)+2500×25=150,000+62,500=$212,500.

These examples show the multifaceted concept of customer lifetime value. When choosing methods to calculate this indicator, you need to consider all the peculiarities of a company's business model.

Why is Customer Lifetime Value Important

The importance of customer lifetime value for analytics lies in the ease of planning. By knowing how much revenue or profit you will get from expanding your audience, you can compare it to the cost of attracting a new customer. This allows you to evaluate the effectiveness of the extensive growth of the company.

Why is customer lifetime value also important? The lifetime value of a customer is also important from the point of view of intensive development. When calculating it, you can divide your customers into groups according to their level of profitability for the business. This will help answer the following questions:

- what category of customers brings the most earnings, what are its characteristics;

- what products are in demand among your priority customers, what task do they solve;

- how effective it is to retain customers from different groups using price-related and non-price-related tools;

- at what stage is it worth putting more emphasis on customer retention;

- what is the expected frequency of repeat purchases;

- how to build communications with customers from different groups.

The actual lifetime value of a customer is essential to forecast the expected performance. For example, grouping your customers and creating an average portrait of each category will help you determine the potential income from a new customer. It's enough to compare a new customer’s characteristics with typical portraits to choose the right engagement strategy.

How to Calculate CLV

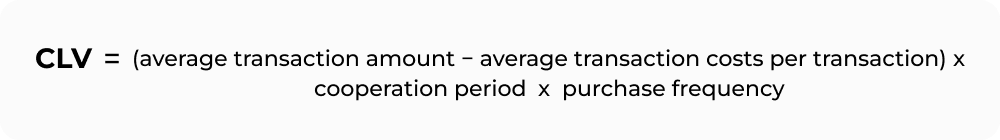

The basic formula for customer lifetime value is as follows:

It can be specified for ease of calculation:

Depending on the nature of a business, the period of cooperation in the CLV formula can be measured in years, months, weeks, days, or even hours. In this case, the frequency of purchases will be equal to the number of transactions per selected time period.

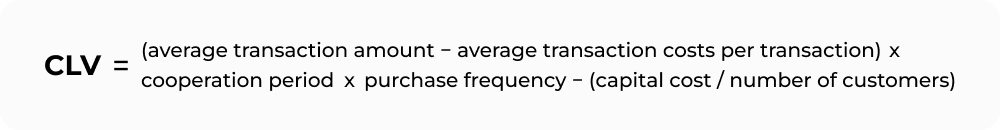

How to measure customer lifetime value if profitability is more important than the total revenue? You can measure the lifetime value of a customer using an alternative formula:

In the first customer lifetime value example, we considered subscribers of a mobile operator. Such companies invest huge amounts of money into infrastructure development and maintenance, staff remuneration, and the development of new technologies. Such capital expenditures cannot be linked to a specific customer, and yet they are taken into account in the calculation of the net profit of the business. Therefore, the most accurate formula for lifetime value will be as follows:

The methodology for calculating the refined indicators is quite complex since grouping clients requires calculating the lifetime value for each customer. That is why most companies use automated analytics systems.

By looking at the formula, it is easy to see that by improving its main metrics, you can increase the lifetime value of customers. Let's understand their meaning and how to analyze them.

Customer Lifetime Value (CLV) Metrics

The main components of the customer lifetime value formula are average transaction amount, frequency of purchases, and period of cooperation. Let's see what customer lifetime value indicates.

Average transaction amount

The average transaction amount is the ratio of a company's total revenue for the period under study to the number of purchases (checks, orders, invoices, etc.). By looking at this metric in terms of different groups of customers, you can learn which marketing methods to use to increase the amount of a check.

Dynamics will also be necessary for analytics - it's important to understand how seasonality affects purchases.

Keep in mind that the metrics of the customer lifetime value model are interrelated. Raising the price may increase immediate revenue but decrease purchase frequency and duration of engagement. Therefore, you need to implement an integrated approach when considering all metrics.

Using the following tips, you can calculate an average transaction amount as accurately as possible:

- Check databases regularly to eliminate duplicate and erroneous checks.

- Review customer segmentation criteria from time to time.

- Consider the indicator in terms of platforms and communication channels.

Purchase frequency

Purchase frequency is the ratio of the number of purchases to the number of unique customers who made transactions during the study period. By analyzing this indicator in different segments, you can determine the loyalty and solvency of customers. The dynamics will also show how successful innovations in the marketing strategy and individual advertising campaigns were.

Purchase frequency is difficult to analyze. It is influenced by seasonality, current trends, and local and global events. To build a marketing customer lifetime value model, you need to extract these factors. This will require a powerful analytics system.

The following tips will help you gain a deeper understanding of this metric and the mechanisms that shape it:

- Conduct surveys and other market research to identify trends.

- Consider the specifics of your products - they may be seasonal or too expensive for frequent purchases.

- Use logic to identify correlations with other phenomena. For example, ice cream and hot drink sales will depend on the average air temperature.

Period of cooperation

The period of cooperation is the sum of the duration of relationships with all customers divided by the total number of customers. Relationship duration is the time between the first and latest purchase. If a customer's latest transaction was two weeks ago, that will be used in the calculation, even if you're pretty sure they'll be back soon.

The indicator itself is a dynamic characteristic. It is important to understand what it reflects in the lifetime value of a customer and how to analyze it. You can group customers by duration of engagement to know where they are in their life cycle and how to build relationships with them.

The following recommendations will help in the analysis:

- Carefully configure your CRM so the collaboration period does not include returns, consulting requests, and other non-transactional interactions.

- Try to rely on up-to-date rather than historical data, as customer behavior changes quite quickly.

- Conduct customer satisfaction surveys and compare them to statistical data.

Ways to Increase Customer Lifetime Value

You can increase the lifetime value of customers by impacting each metric individually. Let's look at examples that will help you increase the value of the individual components of the formula.

Increase your purchase amount with cross-selling and presales

These are simple but very effective methods. To increase the average sale amount, offer a discount on an additional item or a profitable promotion on related products. One of the best ways to attract customers’ attention to such promotions is to place them in a widget. Claspo offers different scenarios for displaying such widgets. You can show them when visitors go to a section with promotional products, on the checkout page, or when the buyer is inactive on the site for a long time.

Remind the customer about your business and share valuable content to increase purchase frequency

According to Duoplus Online Marketing, people can forget about your company within 20 minutes of visiting your website. Don’t let this happen - remind shoppers about your business with well-designed email or SMS newsletters to increase customer lifetime value.

With Claspo, you can create pop-ups that motivate site visitors to share their contact details in exchange for access to special offers or exclusive content. The received email addresses and phone numbers are easily transferred to the ESP and CRM of your choice. As a result, you can regularly communicate with subscribers and attract their attention to your brand, products, and promotions, increasing the frequency of purchases.

Extend collaboration with personalized communication

Personalized communication is a great way to increase customer lifetime value. 78% report they are willing to repurchase from a brand that personalizes its messaging and offers.

And here, Claspo comes to the rescue again. It allows you to display personalized pop-ups based on which communication channel, marketing campaign, or keyword brought visitors to your site.

For example, you can show a pop-up with a discount on a particular product only to those users who previously received an email newsletter announcing this discount. This approach simplifies their path to conversions, increases loyalty to your brand, and motivates them to choose you again and again.

Increase Your Customer Lifetime Value with Claspo

As you can see, Claspo can help you improve key CLV metrics: average transaction value, purchase frequency, and duration of cooperation with your business. But most importantly, improving CLV with Claspo will take little time and will not require significant effort from you.

The Claspo library includes more than 700 ready-made templates for 36 use cases. Simply choose the one that best suits your strategy, customize it in the intuitive editor, set up display rules in a few clicks, and add the widget to your site following our step-by-step instructions.

Since Claspo requires no design or programming skills, your first CLV-enhancing widgets can appear on your website today. In the future, you can conduct A/B testing and determine which widgets provide the best results for your business.

Try Claspo for free and upgrade your plan as soon as your strategy requires it